If you operate a website or business outside the United States and conduct business with U.S.-based companies, understanding U.S. tax regulations is crucial. While the principle that businesses are obligated to pay taxes remains universal, online businesses face unique challenges due to their ability to easily transcend international borders.

Whether you receive payments via checks, bank transfers, PayPal, or other methods, all income must be accurately reported, and the appropriate taxes calculated and paid. Consulting a qualified tax advisor is highly recommended to ensure compliance.

Many online business opportunities originate in the United States. While the U.S. welcomes international participation, U.S. law dictates that income derived from U.S. business activities is subject to U.S. taxation. U.S. companies may be required to withhold taxes from payments to foreign entities.

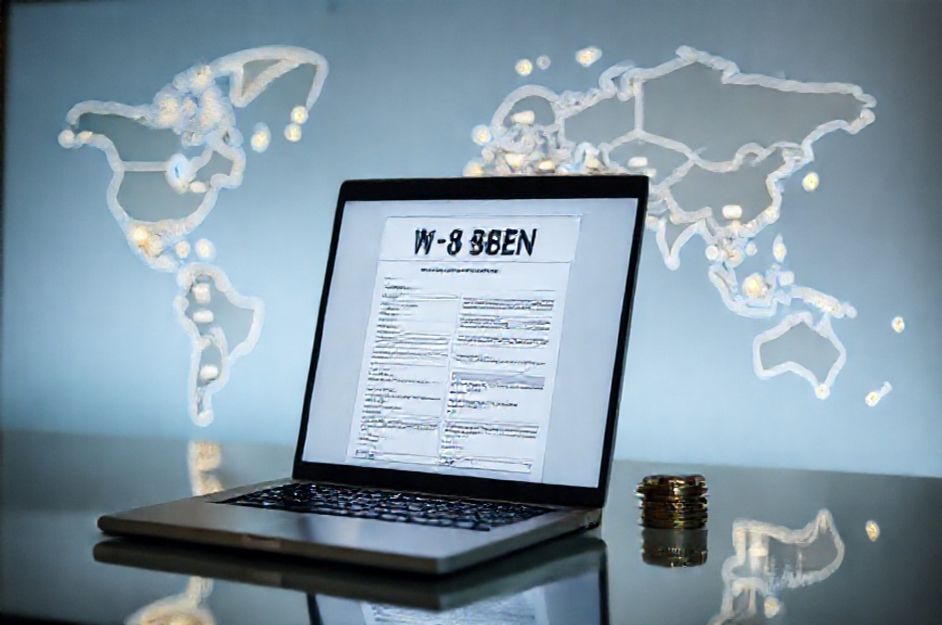

A common concern is whether this leads to double taxation – once in the U.S. and again in your home country. Fortunately, the U.S. has international tax treaties to prevent this. The key is to complete the relevant W-8 series form (e.g., W-8BEN, W-8ECI, W-8EXP, or W-8IMY) and submit it to the U.S. company you’re working with. These forms establish your foreign status and allow you to claim applicable tax treaty benefits.

Google AdSense operates slightly differently by considering your country of origin and providing tailored advice. However, if you have employees, provide services, or maintain equipment within the United States, you are likely obligated to pay U.S. taxes. Simply using a U.S.-based hosting service does not constitute owning equipment in the U.S.

For detailed information, refer to official IRS publications or consult a tax professional familiar with international tax law. Key resources include instructions and forms for the W-8 series, available on the IRS website.